Knowledge center

ATIM LAW FIRM

Industrial Real Estate - Development situation of Industrial Park infrastructure investment enterprises (listed on the stock exchange) as of July 2022

The wave of global investment shifting to Vietnam is creating a bright spot for the industrial park real estate industry. After more than a year of being interrupted by the Covid-19 pandemic to date, this sector's stock code has made a comeback and created a hot fever on the Vietnamese stock market. The Center for Analysis and Investment Advice (“SSI”) expects that net profit of Industrial Park infrastructure investment enterprises (listed on the stock exchange) (“IP Enterprises”) is expected to grow by about 18% over the same period.

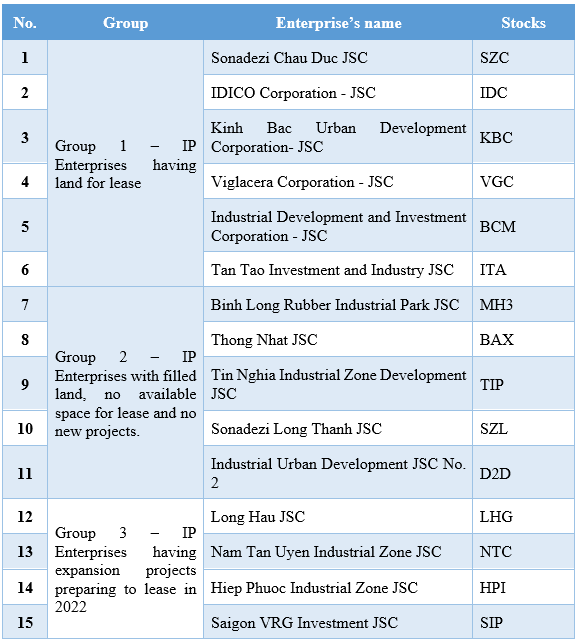

List of IP Enterprises

Basically, IP Enterprises on the market can be divided into 3 groups as follows:

Overview of some IP Enterprises[1]

By the end of the first quarter of 2022, most of the IP Enterprises have recorded quite positive results as follows:

- Regarding IP Enterprises in group 1, it is expected that the shift of production from China will help those enterprises quickly increase the area of land for lease. Specifically, in the first quarter of 2022:

-

- SZC continues to lease in Chau Duc Industrial Park with the remaining commercial land available for lease reaching more than 300 hectares;

- IDC focuses on leasing the expanded Huu Thanh, Phu My II and Phu My II Industrial Parks with benefits on the compensation land area and the land available for lease reaching more than 500 hectares;

- KBC focuses on Nam Son Hap Linh, Tan Phu Trung and Quang Chau Industrial Parks;

- VGC mainly leases new industrial parks such as Dong Van IV, Phu Ha;

- ITA completes leasing infrastructure in Tan Duc Industrial Park, expanding 15 hectares;

- BCM focuses on leasing in the expanded Bau Bang Industrial Park.

Among them, IDC stands out by recording a profit of up to 253%, equivalent to VND 283 billion.

- IP Enterprises in group 2 such as MH3, BAX, TIP, SZL, D2D recorded regular revenue and large cash volume, paying high dividends.

In particular, BAX with the sale of land plots in commercial and service zones recorded a profit after tax of VND 48 billion (an increase of 7.2 times compared to last year).

- IP Enterprises in group 3 such as LHG, HPI, SIP are facing difficulties in clearing the leased area in the Long Hau 3 Industrial Park, Hiep Phuoc Expanded Industrial Park and Le Minh Xuan III Industrial Park.

Outlook for the second half of 2022 of IP Enterprises

According to data from SSI, the total revenue in the first quarter of industrial park developers (listed) reached more than 14,700 billion VND (up 0.4%/year).

SSI also forecasts that after-tax profits of IP Enterprises in the last 6 months of 2022 may grow by more than 24%, mainly due to the sharp increase in the rental land area on the low base of the last 6 months of 2021.

In 2023, the net profit of IP Enterprises is expected to grow by about 18% over the same period, due to: (1) the total area of leased land grows by 10% per year; and (2) land rent is expected to increase by 8% in Southern Vietnam's Industrial Parks and 6% in Northern Vietnam's Industrial Parks by 2023. Of which, KBC's profit after tax is estimated at VND 3.7 trillion (up 25% over the same period) as current projects continue to be the main source of income, besides phase 3 of Trang Due Industrial Park project and Industrial Zones in Long An can start to generate income. IDC's net profit is estimated at VND 2.2 trillion (up 24% over the same period) mainly due to profit recognition from expanded Huu Thanh Park and Phu My Industrial Park, in addition to divestment in subsidiaries.

Tran Thi Ngoc Ly (Paralegal)

ATIM LAW FIRM

ATIM LAW FIRM