Knowledge center

ATIM LAW FIRM

Industrial Real Estate - Prospect of the industrial real estate in the last 6 months of 2022.

In the last 6 months of 2022, the industrial real estate in Vietnam is aiming for sustainable development and has a positive outlook. Hereinafter, ATIM LAW FIRM will summarize some promising news regarding industrial real estate market in this post.

The industrial real estate market in the first half of 2022, although facing certain challenges, still recorded many positive signals and the outlook for the last 6 months of the year is extremely positive.

International flight routes open supporting industrial real estate industry to recover

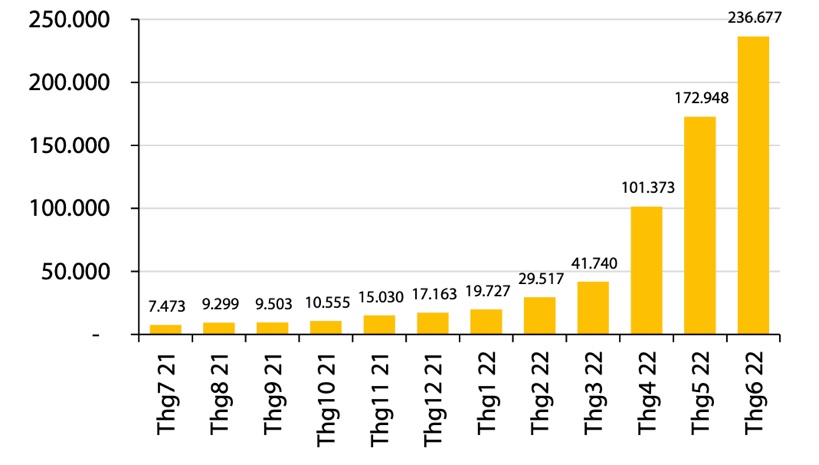

Number of tourists to Vietnam

Soure: tradigeconomics.com

International tourists to Vietnam recorded a strong recovery in the first half of 2022 as Vietnam began the "new normal" policy after the COVID-19 situation improved and international flights resume after two years. In the first 6 months of the year, the number of tourists increased by 582.2% to ~602 thousand.

The opening fully supports partly promoting leasing activities in industrial zones. According to a statistic from CRBE, there are a significant number of pre-built factory and land lease requests to CBRE compared to previous years.

Statistics show positive signs

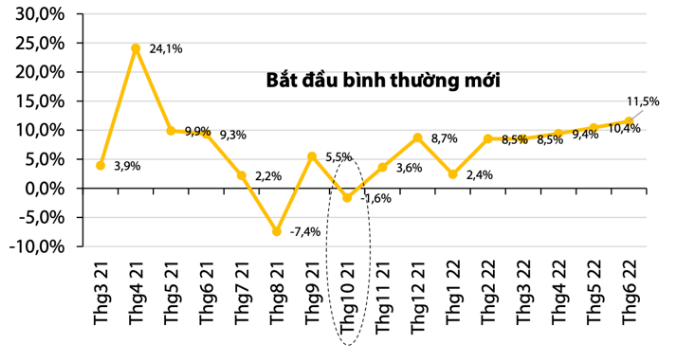

Monthly Vietnam PMI

Soure: tradigeconomics.com

Monthly Vietnam IIP (YoY%)

Soure: CBRE

Vietnamese factories rebounded strongly in the first 6 months of the year as PMI ended at 54, marking the 9th consecutive month of factory operations expanded when no longer disrupted by travel restrictions due to the COVID-19 outbreak.

Besides, Vietnam's industrial production index continuously performed well and showed positive growth since Vietnam stopped social distancing and started the "new normal" policy in October 2021.

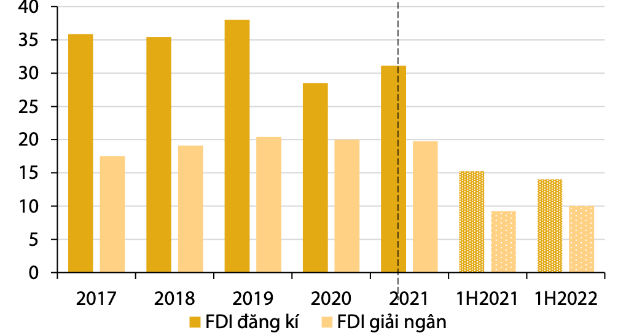

FDI inflows remain stable

FDI inflows

Soure: Rong Viet Stock Co.

FDI registration structure

Soure: Rong Viet Stock Co.

In the first 6 months of 2022, disbursed FDI reached 10.06 billion USD (+% 8.85 years). The processing and manufacturing sector continued to lead in attracting investment capital, with registered FDI capital reaching 8.8 billion USD, accounting for 63% of total investment capital. There were 84 countries and territories investing in Vietnam in the first six months of the year. In which, Singapore leads with a total investment of more than 4.1 billion USD, accounting for 29.5%. South Korea ranked second ~ 2.66 billion USD, accounting for ~ 19% (+29.6% YoY). With a large-scale Lego project worth more than $1.3 billion in total investment, Denmark ranks third with a total registered capital of ~ $1.32 billion.

Long-term development infrastructure, attractive cost and profit

The North-South expressway system throughout, combined with the Government's master plan in developing the seaport and airport network by 2030, with a vision to 2050, will enhance the logistics capacity of Vietnam and means that logistics costs will be significantly reduced. This will catalyze the growth of industries and international trade and reduce the uneven distribution of industrial concentration across regions.

Summary of factors affecting the business environment

Soure: Savill, Cushman % Walkerfield, Arcadis

Data collected from big cities in each country

Southeast Asian countries are dominating the market in attracting manufacturers from China thanks to reasonable costs, increased domestic consumption, and improved infrastructure. Vietnam is a rising star among Southeast Asian countries that has become a leading industrial center thanks to its competitive advantage over other countries in the region. Besides a stable political background, Vietnam also participates in many FTAs. In addition, investment costs and recurring costs are still relatively low compared to peers in the region, reinforcing the attraction of foreign investment to Vietnam in the manufacturing sector.

Industrial real estate is still bright in the second half of the year

According to the SSI Securities Analysis Center (SSI Research), in the second half of 2022, the profit after tax of industrial real estate will increase by 47.3% over the same period, thanks to the expected industrial land demand. A positive recovery is expected when the economy opens, and rents are expected to continue to increase by an average of 8-20%, depending on the region.

SSI Research also continues to assess that industrial land rental demand will still grow positively in 2023 thanks to the continuing trend of shifting production from China to Vietnam and policies to attract FDI will also promote investors returning to Vietnam.

By 2023, SSI Research estimates that the net profit of listed industrial zone developers will grow by about 18% over the same period last year, due to a 10% growth in the total area of leased land per year and the projected land rental price is expected to increase by 8% in the southern industrial zones and 6% in the northern industrial zones.

However, in terms of risks, SSI Research said that the occupancy rates of industrial centers such as Binh Duong, Dong Nai, and Bac Ninh have all reached over 80%. The time for compensation for site clearance is slow, leading to a small supply of land in the remaining industrial zones, affecting the leasing of large areas.

ATIM LAW FIRM

ATIM LAW FIRM